We were excited about the numbers reported by our affiliated partner Keeping Current Matters in their Monthly Market Report and wanted to share them with you.

So, as we get started, we’re going to be talking about the economy, housing recovery, where home prices are going, and what’s causing people to move right now.

Here is a quote from the Wall Street Journal.

As we near the end of August, we can see that economic recovery is starting to happen

The strength of that is going to depend on how well we contain and really manage COVID-19 moving forward.

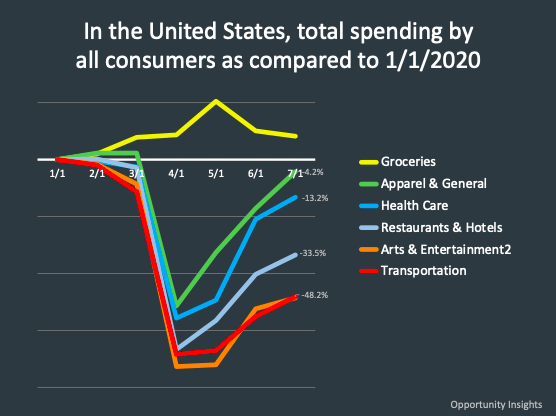

As August ends we are starting to get a look at what’s going on with consumers and see how the external health crisis impacted our economy

If you’re in the grocery business over the last several months with everybody eating at home, your business has soared. While other businesses have fallen. You see that deep fall in the end of March and into early April, then hitting a bottom and starting to come back up.

We are not seeing transportation and things related with travel recover as quickly. Moving forward I think the trend will be we see some businesses recover quicker than others.

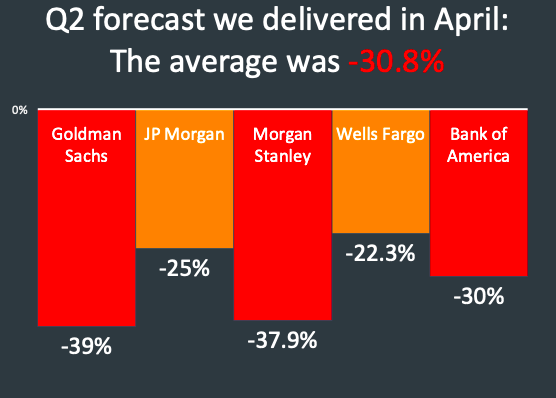

In the second quarter the forecast that experts delivered, showed an average right at 31, -31%, meaning the economy would constrict by 31%. And you can see those estimations here.

Now what actually happened is the economy constricted in the initial advanced estimate by 32.9%. So, very, very close to what these experts said would happen in the second quarter.

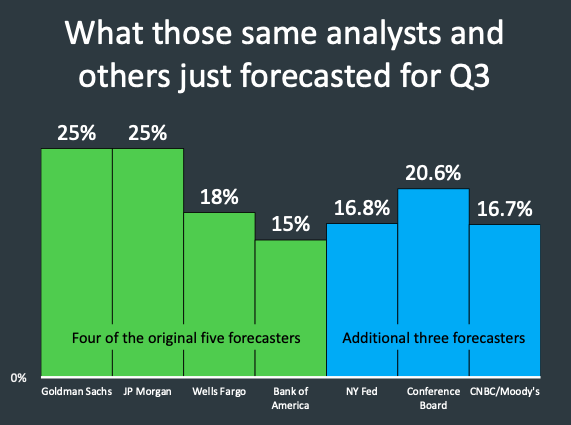

The current predictions for Quarter 3 are relatively encouraging to economic recovery. Those same analysts just forecasted, and a few more, for Q3.

On the left, in green you have the original five forecasters, and on the right, in blue there are the additional three forecasters. All of them anywhere from 15 to 25% economic recovery over the last quarter of the second quarter as we go forward.

We are starting to see economic recovery happen, and there are a lot of questions going into the fall.

I think this is interesting perspective for Morgan Stanley here.

We have seen numbers dip down, businesses impacted financially, and some businesses close. Now we are starting to see them rebound back from it. Some quicker than others.

As we look at general economic numbers, we can look forward to seeing some significant improvements going forward.

Now this leads to if we look at the overall economy, what’s happening in the housing market. How are we recovering there? I put together a couple of clips from several economists from across the spectrum and what they’re saying and it’s very interesting. It almost reads like a movie trailer here.

Really summing up that where the housing market is right now and blowing away what experts have thought. Really underscoring the strength of housing right now, and the importance of housing.

If we want to really look at what’s going on, we have to start to look at consumer behavior.

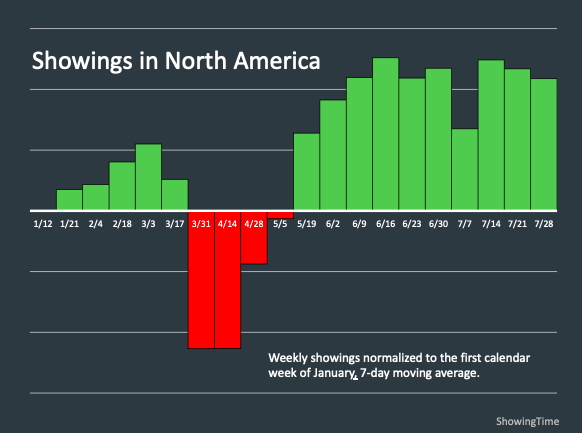

Showing Times numbers from January show us that people are again out and looking for houses.

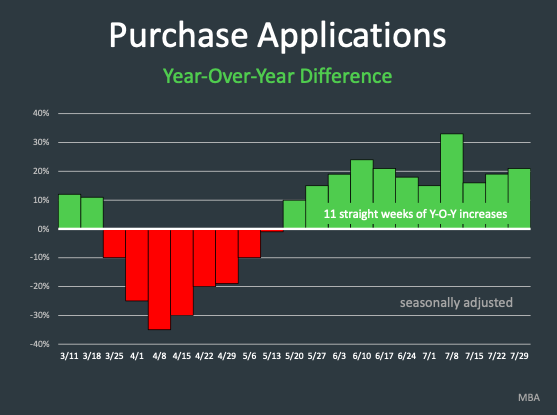

Just like the economy, we saw a dip in showings during late March and April, but it’s coming back. The trend since mid-May shows people are going out and looking at properties.

Coming from Ivy Zelman, she says this: “Whether in terms of pending contract activity or our proprietary buyer demand ratings, the various measures of demand captured in this month’s survey can only be described as shockingly strong (another one of those quotes we used before), in spite of the resurgence of COVID-19 cases.” So, we’re seeing that come back

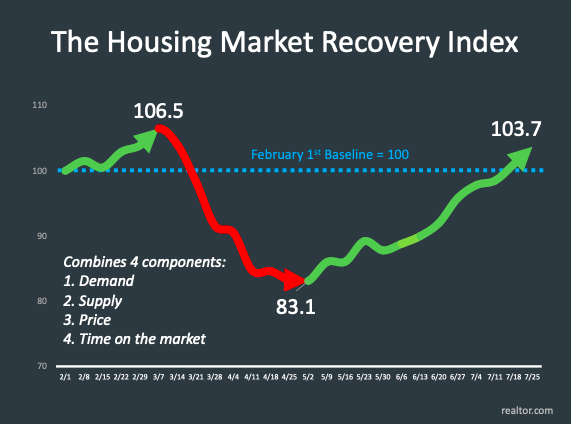

The NAR housing market recovery index really takes four things, demand, supply, price, and time on market.

You can see the numbers dip down and rise back up. We are now at a point that is above the February 1st baseline.

I think the question that starts to come up and is on a lot of people’s minds, is what’s going to happen to prices.

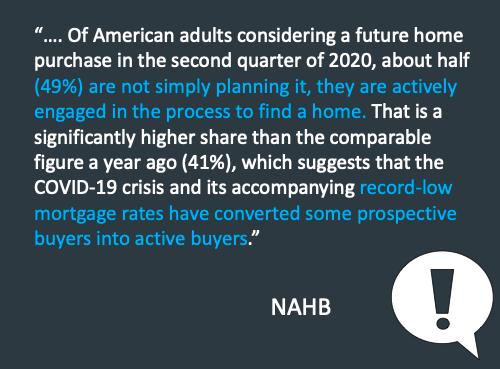

Quicken Loans came out and said this: “The pandemic has not stopped the consistent home price growth we have witnessed in recent years.” I think this is indicative of the recovery and coming through that. We’ve seen housing literally become more important through this pandemic. More important to people, the needs become more important in really driving that demand.

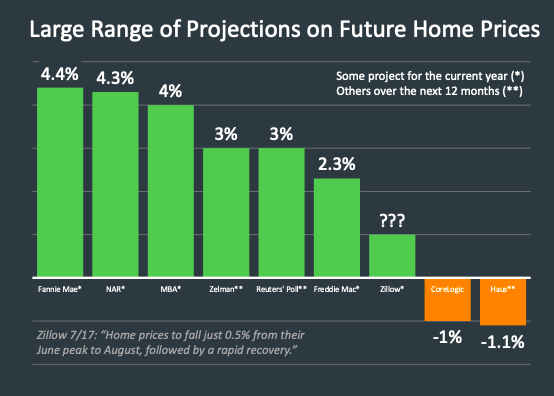

There’s a large range of projections on what’s happening with housing prices.

This is a collection here of nine experts and what they’re saying about housing prices. Anywhere from 4.4 appreciation, all the way to the very right to about 1% depreciation.

Now the interesting thing here is that CoreLogic just revised their estimate. They were saying originally, we were going to see about 6.6% depreciation, which blew us away.

We respect them but disagreed in this case with that projection because we believe supply and demand will always dominate pricing.

Now I want to look into that CoreLogic issue because here’s what they said.

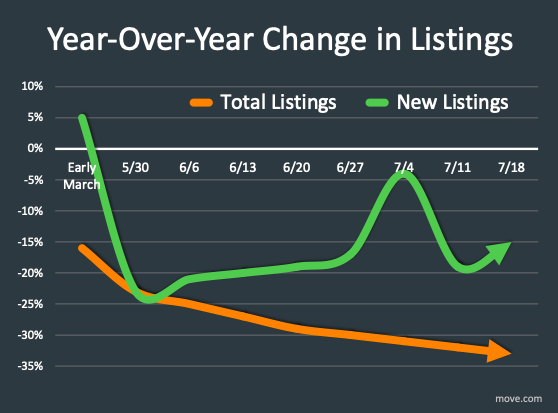

That’s a massive correction they’ve made to their forecast. But again, the story right now across the country is that as we look at listings, they’re lower than they’ve been even though we continue to bring listings to market.

Just like stores can’t keep their shelves stocked, we can’t bring homes to market fast enough. People are coming in and buying them as quickly as we list.

In May realtor.com reported high traffic with a record breaking 85 million, only to be beat in June with 86 million.

People are saying you know what, we now have different needs in the home that we’re looking for. In some cases, it may be less or more space, while some may want a backyard. No matter the need, there’s a high chance their needs have changed over the pandemic.

We’ve been through 11 straight weeks of year over year increase, meaning applications are higher this year than last year.

I think we can fairly say across the country we don’t have the supply or the inventory we need for homes, and we have a lot of people that are looking and ultimately going into contract to buy a home.

Many of those in multiple offer scenarios, meaning somebody else didn’t get the house so they’re still looking for.

Not only are things more important today, demand is being driven by white hot interest rates. People are saying now is the time to do what we’re going to do. The payments at a price that we can afford

Interest rates are projected to remain low, but as the economy improves, we know that those will start to edge up.

Now the other side of that is why are people moving today? What is causing them to make those decisions. And I want to bring some interesting information into this conversation because I think there are specific things happening right now that are causing people to say we want to do something different.

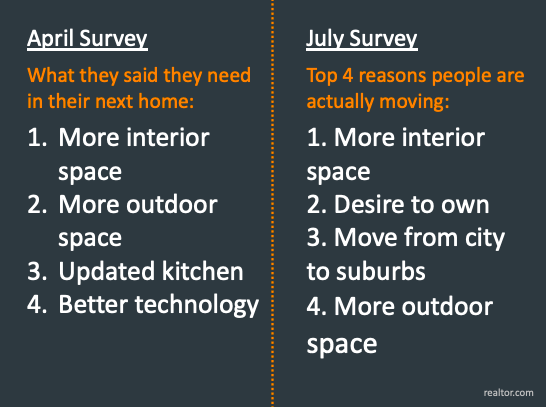

This is a survey that came out of realtor.com comparing an April survey of what people said they needed in a home, to July and why they actually moved.

If you look back to April, you see interior space, outdoor space, kitchen, better technology.

Moving forward to July we still see interior space, but number 2 is the desire to own, which I find very interesting, as we’ve talked about how the home ownership rate in this country has grown over the last quarter, and that the desire to own is very important to people.

Number three, the move from the city to the suburbs. We’re seeing actual data right now showing, people say I don’t want to live in as a dense environment. I want to move from a city to a suburb because of the fears of maybe being in a tightly congested area or contracting the coronavirus.

Number four, more outdoor space. I want a yard for my children during this time because we’re all at home. I want a different option.

So, we’re seeing this come through in the actual data that people are saying hey there are different needs that I have. There are different things that are happening in my life and I’m going to make a decision on the home that I purchase based on those

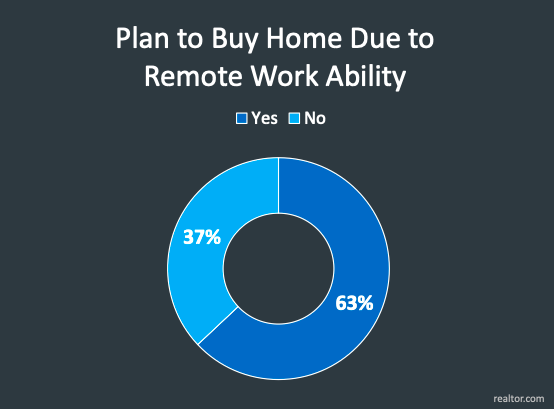

Another big driver of this right now is the plan to buy a home due to the possibility of remote work.

Two out of three buyers surveyed said they are planning to buy a home that fits their needs for remote work.

Now there’s something very interesting form John Burns’ Consulting here that I want to bring in.

They’re calling for the great American move, based on all the things that they’ve listed. The ability to work from home, financial reasons, life change, people just saying we’re making different decisions today, and it’s certainly beginning to manifest that way.

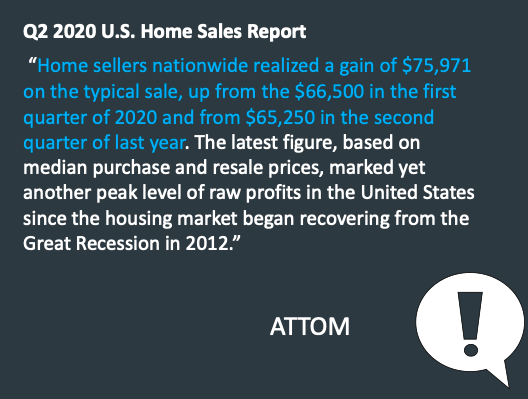

So, as we start to wrap up, I want to bring in one other piece of information from ATTOM Data Solutions that’s important right now. And this is coming out of the second quarter

We’ve talked a lot about the significant amount of equity in people’s homes today. And a lot of that due to tenure and the way people have stewarded equity in their homes over the last gosh, ten years.

We are seeing sellers net more out of the sale of their home.

That means right now somebody that’s thinking about selling has an opportunity to go out and make a move relative to things that are important to them. This is the kind of information that we have to get in front of people, significant equity gives you options.

We want to help sellers achieve those plans and realize the potential they may have with the equity they have in their homes.

The fall buyer and seller guides are coming out September 4, and if you are considering buying, or selling you will definitely want to take a look at these so you can make a powerful and confident decision. If you are interested, please reach out to us so we can get a copy to you.

Do you know how much equity you have in your house?

If you are considering selling, now is the time to request a professional equity assessment report. Knowing how much equity you have gives you the ability to make informed decision regarding your future.

Do you know how much equity you have in your house?

Let's talk!

If you've been consider buying, or selling, I'm sure you have questions. Our team would love to talk with you and discuss the next steps in the process.