- in Blog , Buyers , Investment Homes , Investors , Newsletter by Secure Investments Realty

Demystifying Real Estate Investing Part Three | Finding Property and Running The Numbers

Demystifying Real Estate Investing

Part Three

Finding Property and Running The Numbers

These last few months we have been talking about demystifying real estate investing. In Part 1 we talked about buying with no money down, and I offered some information on down payment assistance programs.

In Part 2 we talked about Real Estate Investing for the beginner; Educating yourself on Real estate investing and studying properties on the market.

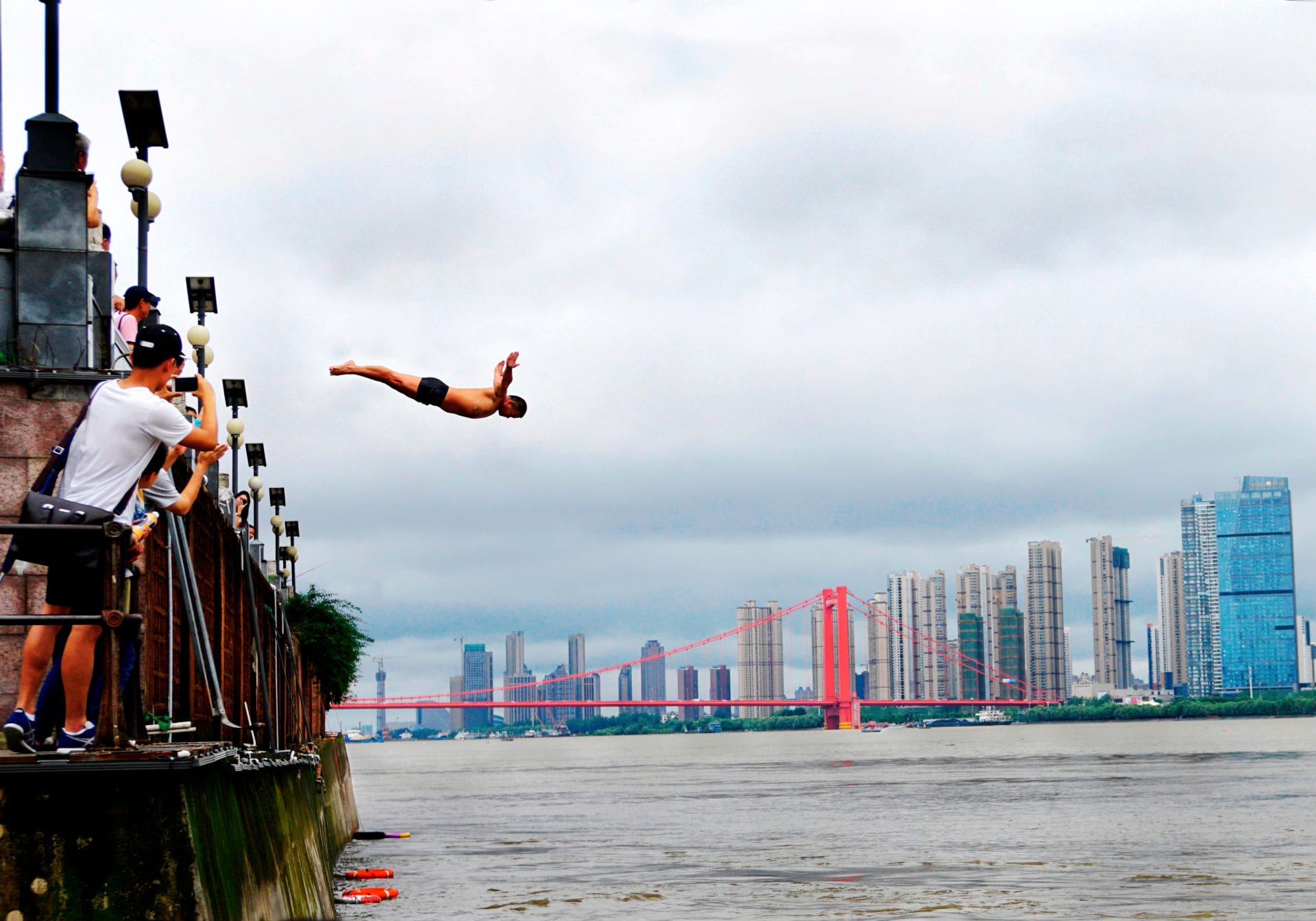

This Month We Will Dive Into

Selecting property

Qualifying property

Preliminary run the numbers

Let's assume for the last several months you have been doing your homework and studying the market. You're using your handy real estate apps or websites I recommended and have been receiving updates from them and/or your Realtor.

You are familiar now with both rental and sales values. Of course, you could leave that to your very trusted and qualified Realtor that knows both markets and will hold your hand and advise you all the way. But let me tell you if it were easy to find good investment property more people would be investing.

This is typically one of the major roadblocks for people because you do have to literally study and know the market very well to know what a property will sell and rent for.

Not all Realtors know both markets or are very good at evaluating a property for both rent and sale. The Realtors in my area know they can email or text me an address if they need a rental value for a potential investment property and I am happy to give it freely. Make sure the Realtor your working with is knowledgeable in both markets.

Market Study

- Price per square foot

- Days on market

- Sold prices

- Leased prices

- Concessions

- Quality of Materials

As you study the market pay close attention and note the price per square foot a property has Sold or Leased for. Noting the differences in square foot price for an average property with medium grade fixtures and appliances. Note the price per sq. ft. for Higher-priced homes that have a better quality material like granite or quartz counter tops, stainless steel appliances, real wood floors, modern tile, etc. Note your price for the Handyman special or Fixer-Upper's that may need paint, flooring, counter tops or has other deferred maintenance.

Look at what the property SOLD or LEASED for not what it was LISTED for

Many people make the mistake of looking at what is currently on the active market and price their property based off that price. But what someone wants to get for their property and what they actually get for their property is often different. While you do need to look at the active properties so you know what your property is competing with you don't price your property based on that. However, it does inform your decision. When you look at the average days a property is on the market you can tell if its a Hot Market by low number of days on the market. If you have looked at the active properties (your competition) and there are not many or any available then you may be able to push your price up a bit.

Find out if there were any concessions given like Seller paid closing costs, a free month rent, or no security deposit. If there are concessions that could mean it is a slower or saturated market and people are having to make deals to get it rented or sold. It could also mean they paid more for the property and made up for it in the concessions (like increased price due to Seller paid closing costs.)

After you have done your homework you will be able to start forming your own opinion on what you think a property would Sell or Lease for. You have gotten your funds in place for your down payment and pre-approval letter from your preferred mortgage company and you're ready to start making offers. If your dealing in cash you will need to provide proof of funds when submitting your offer.

Create your search query filtering it for the location, price range and style of property (home or condo, etc) and come up with a list of available properties to consider purchasing.

Filter your search and drill down into specifics

Location: For your first investment you should get something within driving distance in case you need to handle repairs and leasing. Find an area you wouldn't mind living in (or going to at night if needed with out protection... lol)

Price range: This is dependent upon how much money you want to put down and how much of a mortgage payment you're comfortable with. Like I discussed in Part 2. Everyone's appetite for investment is different so find what is comfortable for you. I like to have a mortgage that I would be willing to carry for 4 months in case I had to do an eviction and renovation afterward during a slow time of year. Realistically it is rare that a property I provide property management services forgoes vacant for more than a few weeks unless were doing a lot of renovations or having to wait on the Owner to send funds. But again, it is your personal appetite for risk that will determine the purchase price you're going to look in. Keep in mind you will typically need 20% down. So maybe you work backward into that number by deciding how much of a down payment you want or have to put down.

Neighborhood: You can drill down to choose specific subdivisions or areas of town that you think are nice and would attract renters easily. This typically means fairly close to conveniences, schools, parks, and shopping as well as easy to access (no long dirt roads with a bunch of potholes or in the middle of the woods). Most Real Estate apps will assign properties a walk-score that will let you know how conveniently or not so conveniently located a property is. Not everyone is a country girl like me LOL). The further away from these things the less rent you typically get (But that is relative to the purchase price, so it doesn't necessarily mean don't buy it. It just may not be the easiest to rent)

Bedrooms and baths: I find it easiest to rent 3 bedroom homes. That is your most frequently sought after size. Two bedrooms may get into condo's being they don't build a lot of 2 bedroom homes and 4 bedrooms may get too pricey. Again, price is relative so if you find a good priced two-bedroom condo I am not saying don't buy it. I am just advising on most commonly sought after property.

Hit that search button and study your results: I like to sort my results many different ways when I am looking at it. First by Price range lowest to highest and review. Then sort it by price per square foot. Review the pictures. Kitchens and Baths speak volumes discard those that you can see are overpriced based on condition and get it narrowed down to a handful that looks correctly priced

Study your final handful of potential properties: Take a good look at days on the market, price and listing history. If it has gone pending in the past and then put back on the market It may indicate the property may be having a hard time selling. That could be because it failed the buyer's inspection, or they couldn't get financing due to appraised value or condition. I would try to find out through your agent. The seller may be worn down from previous failed contracts and be ready to negotiate.

Sorting by the cost per square foot gives you an idea of whether there's room for improvements on that property that you might be able to capitalize on by doing some basic upgrades (flooring, counter tops, fixtures)

Find a handful that you feel look priced right and start drilling down on the numbers. Don't rely on automated estimates from Zillow or the like. They don't take condition, location, and fixtures into consideration. Apply the rental rate per square foot that you have determined applicable for each property (high medium low based on the homes current condition) and note what you think each will rent for.

Figure the monthly expense

- Property Taxes

- Insurance

- Home Owners Association Dues

Gather your numbers for the property taxes and Home Owners Association (if there is one). If there is an HOA you will want to review their financials and budgets to make sure it's stable and no pending or outstanding assessments are due. Read through the restrictions on renting. Some may require approval and or the tenant to apply and be approved by the association. You may decide to search out properties without HOA's if your not a fan of dancing to their tune or paying them some of the cream off the top like me 🙂 But renters do love living in homes that are in HOA's because they typically will have community amenities like swimming pools tennis courts clubhouses etc.

Keep in mind the property taxes will go up when you purchase the property if there is a current homestead deduction and save our homes tax deduction in place. Look at the tax records to determine this. If it currently has an exemption you need the non-homesteaded property tax amount. You can call them or me if you need help figuring out the taxes without exemption.

Insurance will be around 1200 per year for a non-flood zoned average moderate priced home that's not older than 30 or so years. Older homes sometimes cost more to insure and you have to have a four point inspection (Roof, Plumbing, Electrical, HVAC). When I do a quick and dumb number, I just use an average of $100 per month.

Figure your monthly mortgage payment Principal and interest here's a handy calculator to help with that. Take a look at your bottom-line expenses and based on your new-found experience figure out the market rental rate for each of the properties.

Now run your final numbers on each property. Total monthly cost (principal, interest, insurance, taxes, HOA dues) subtract the monthly cost from the monthly rent to see your monthly cash flow.

I know everybody thinks there's a magic rule of thumb of how much you should clear to make it be a good investment but quite frankly there are many rules of thumb and they're all different. This again is determined by your personal appetite and comfort level and end goals.

There are also more things to consider like your long-term plans, holding time, future maintenance and age of systems, renovation cost etc. Each persons and property's bottom line may be different.

I prefer a 15-year mortgage and for the property to pay for itself. I am saving a lot of money on the interest with a 15 year mortgage so I may even contribute a small amount per month if it doesn't break even.

If I feel I need more wiggle room on my monthly cost I'll get a 30 year mortgage and I'd like to see around $200 per month cash flow above expenses. I hold my properties long-term and intend to use the monthly rent for retirement income.

I still own my first home that I purchased. It was at age 22 and it has been a great little rental. I lived there for about 7 years then built a custom home and rented out that first home. Then bought another house and rented the custom-built one, so on and so on. I have refinanced and/or got a home equity line of credit several times, pulling out the equity and using it to buy different properties.

If you're not into holding long-term and being a landlord then you're going to want to likely buy properties that sell for less per square foot because they need some work and your goal would be to make money renovating the property and turning around and selling it at a higher price. If that's your plan then it is extremely important that you have the money and the people lined up and ready to go and you get in and get out quick.

Perhaps you only want to hold it for about five years and then upgrade to a different one. I personally never wanted to let go of them because it cost so much to acquire a new property that you might as well do your best to scrape all your pennies together and just come up with the down payment and keep the old rental too.

There are other strategic ways to buy property like working the distressed property market. It is a way to find good deals but they take consistent reaching out to the Owner contacting them frequently and offering to buy them out of their situation before they are foreclosed on. There is also buying Tax liens, but all of that is for another discussion.

This is the basic advice from a girl in the trenches doing the work of managing, maintenance, and leasing properties for over 3 decades and several hundreds of Owners. You start seeing what works well and what doesn't. It's also from personal experience owning rental properties and helping numerous investors fix, flip and/or hold their investments.

Now go look at those properties! This part is far more fun than the first part and we will talk about that next month in our final part to this four part series. Stay tuned for next month's Contract to Closing

Feel free to check out our other feature articles or see the related posts below. You can also sign up for our monthly newsletter. The subscription form can be found on this page in the sidebar to the right. Just scroll to the top of the page and you will see it. Our newsletters are chock full of tips, recent and upcoming events, things that are happening in the community, good will endeavors, property management service information and fun news and updates about our company and the people that make it happen!

No need to look at a list of property management companies! If you are interested in Gainesville FL Property Management please contact us. We can be easily reached here on our website by completing the contact form above on the right. You can also email us at [email protected] or via phone (call or text) 352-478-8029.