- in Blog , Current Topics , Investors , Maintenance Corner , Newsletter by Secure Investments

High Home Prices, Limited Supply Continue to Drive Diverging Sentiment

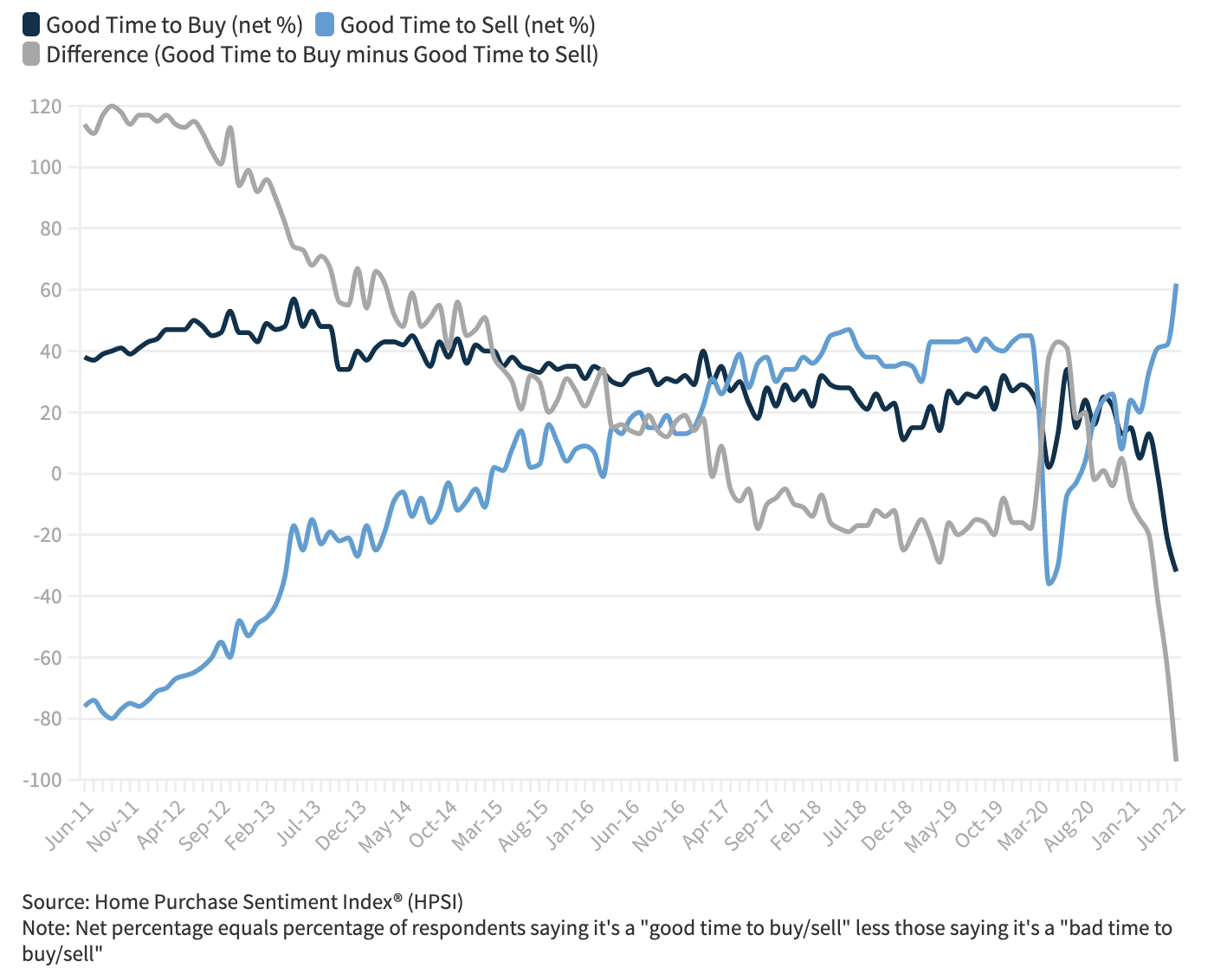

Fannie Mae recently released their Home Purchase Sentiment Index (HPSI). Though the survey showed 77% of respondents believe it’s a “good time to sell,” it also confirms what many are sensing: an increasing number of Americans believe it’s a “bad time to buy” a home. The percentage of those surveyed saying it’s a “bad time to buy” hit 64%, up from 56% last month and 38% last July.

When it comes to housing, there’s no denying that the U.S. is currently experiencing a seller’s market. However, there’s some confusion about the underlying reason.

We’ve all heard the sad stories. Tearful would-be homebuyers being outbid at every turn. Frustrated and exhausted agents turning the town upside down to find them a home.

The struggle is real, and the data backs it up.

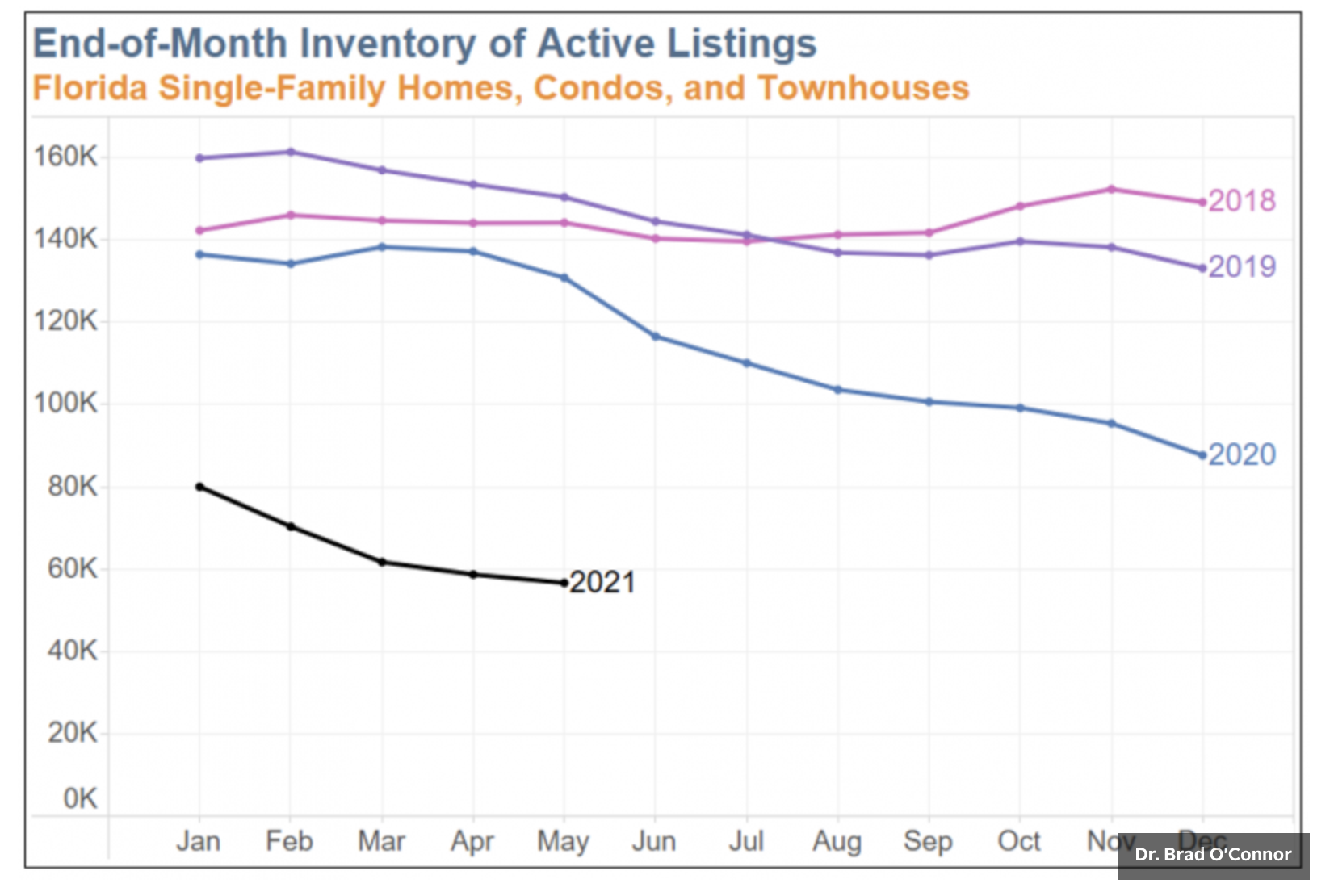

In Florida there were only about 60,000 active listings of homes for sale at the end of May. That’s approximately a 56% decline from the more than 135,000 homes that were on the market at the end of May 2020.

It also happens to be the lowest level of inventory ever reported by Florida Realtors Research Department, whose statistical records extend back to January 2008. The department calculates monthly resale market statistics from data provided by Florida’s numerous multiple listing services.

It's not just Florida being affected by this decline. Recent housing market commentary from national real estate analysts and economists has zeroed in on the low inventory counts being reported all around the country.

Unfortunately, though, this laser-like focus on inventory levels – along with all those vivid stories of buyer hardship – has given rise to a broadly held belief that significantly fewer homes are being listed today than before the pandemic.

And thankfully it’s not really true.

Inventory is not a good measure of how many homes are being listed for sale. When it falls from one month to the next, the truth is fewer listings became active compared to the number that became inactive. A home going under contract affects inventory just as much as a home being listed for sale.

Most housing market commentators have been so busy telling you about our shockingly low inventory that they’ve forgotten to mention what’s going on with another key statistic: new listings of properties for sale.

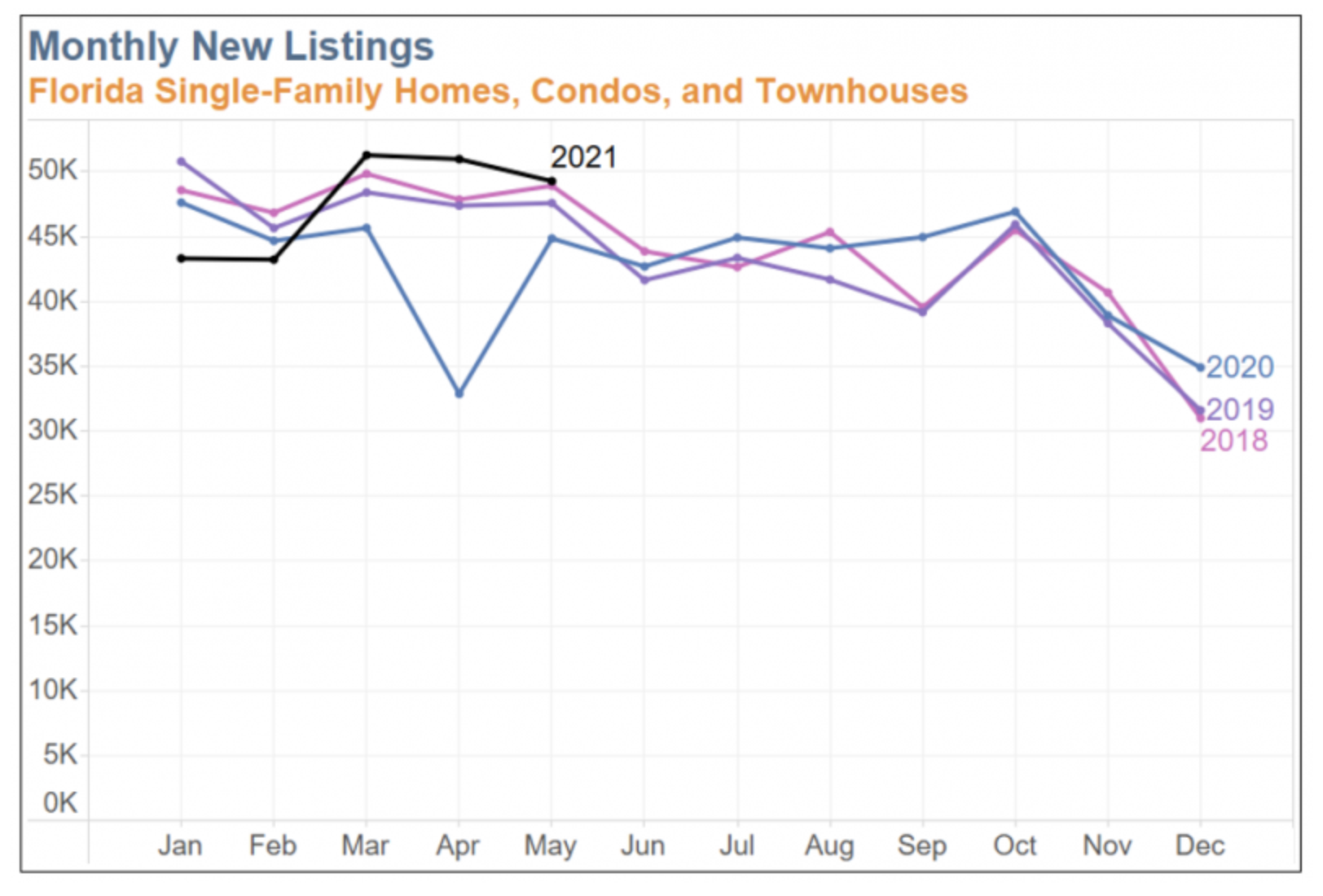

Well, here’s what’s been happening with new listings. From January through May of this year, more than 246,000 existing homes were listed for resale in Florida.

That figure should raise some eyebrows. It is quite close to the roughly 250,000 and 248,000 properties that were listed during the same period in 2018 and 2019, respectively. And with the exception of those two years, it’s the largest total recorded for the first five months of any year dating back to at least 2008.

In truth, apart from a bad April last year (30% fewer new listings than in April 2019), the number of properties coming onto the market each month wasn’t substantially different during the pandemic than what it was pre-pandemic.

The count for July through December last year – over 263,000 – actually set a record for the second half of any year, coming in about 10,000 listings above 2018’s tally.

We’ve been seeing this trend for several months now, not only in Florida, but also across local markets and different property types. Local data from markets across the U.S. also reflect this trend, indicating it is happening nationally.

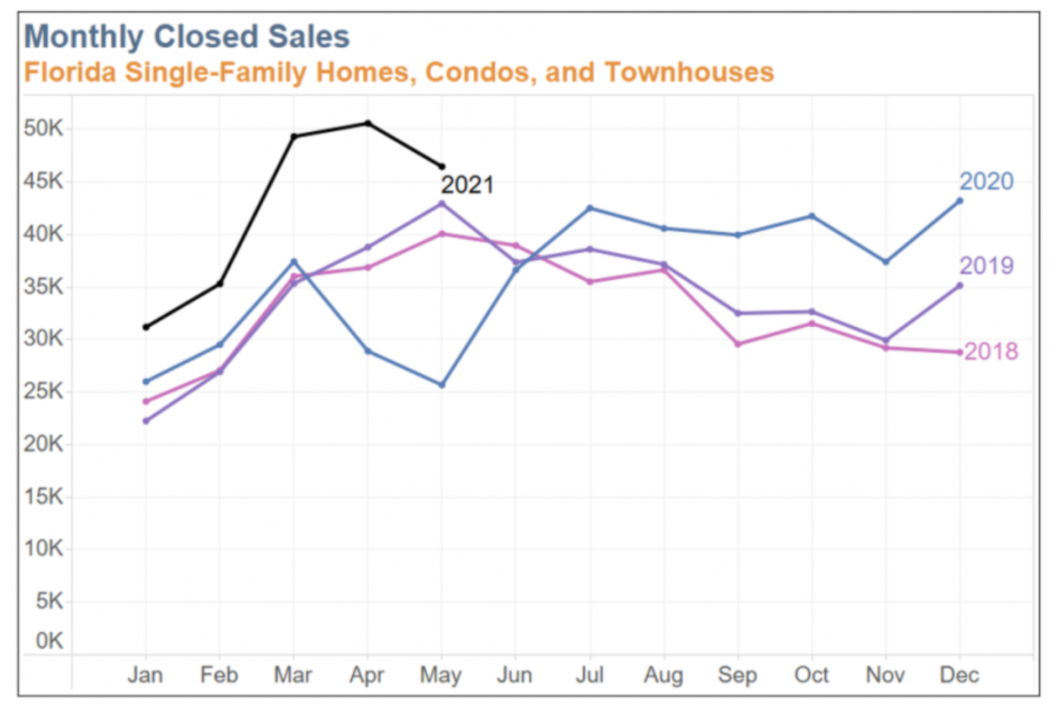

So why is our inventory so low? Because homes are selling fast. There have been more closings than in the early months of last year due to the onset of the pandemic. However, we’ve also had 28% more closings than during the equivalent period in 2019. Half of the sales that closed this May were only on the market for roughly 12 days before going under contract. In May of 2020, that figure was 34 days and in May of 2019 it was 44 days.

A lot of homes being listed aren’t even showing up in the end-of-month inventory figures. They’re going under contract before they can be counted.

Inventory has been eaten away by a huge influx of buyers motivated by record-low interest rates and a pandemic-driven desire for a change of residence – not a decline in new listings.

“Affordability is likely to worsen before it improves, so try to buy it now, if you can find it.”- Mark Fleming

And how can we talk about the current housing market with out mentioning lumber?The lumber industry definitely misread Covid. When the pandemic started, the assumption was that new home builds would slow down, which is where most lumber goes, However, that turned out to be false and the exact opposite happened. A pandemic surge in home buying and renovation sent lumber prices soaring. As home building and renovation soared amid pandemic lockdowns, the price of lumber rocketed from around $400 per thousand board feet in February 2020 to an all-time high of over $1,600 in early May. Prices have since fallen to the $800 range, which is nearly double pre-pandemic rates and could potentially be the new level for the near future.

“Affordability is likely to worsen before it improves, so try to buy it now, if you can find it.”- Mark Fleming

Psssssttttt!!!

Mention this Newsletter and receive the first two months property management services for free with nothing due at sign up!

Check out our homepage for links to all of the property management services we provide. We service a 30 mile radius of the Gainesville FL area. Our website has information for all of our clients. Investors, Owners, Buyers, Sellers and Tenants.

We strive to offer the superior service, and to keep and earn future business, and your referrals.

Our featured article provides tips and insight to our current and future investors looking to fix and flip property or renovate and rent! Both options are lucrative and if you have interest in these types of purchases please get in contact with us. You can reach out to us via our contact page, the sidebar contact form on this article or by texting and or calling 352-478-8029.

We will be more than happy to provide you a free home evaluation. There is not any obligation to hire us for our services, and we are one of the top rental management companies Gainesville FL.