- in Blog , Current Topics , Newsletter by Secure Investments

Real Estate Tax Changes and COVID Relief : What You Need to Know

On Wednesday, January 20th, President Biden took the oath of office at a ceremony that was drastically different from past ceremonies due to Covid 19.

As his polices begin to come to light, if like our team you are anxiously waiting to see how policy changes may affect you and your real estate business.

Impact of Biden’s tax plan on Real Estate What we know

The topics below highlight where you will see some of the proposed changes which could have a significant impact on the real estate industry. It is important to be aware of how the application of these potential changes can affect your specific circumstances.

- Pay Roll Taxes

- Increase Highest Tax Rate

- Carried Interest

- Long Term Capital Gain and Dividend Rates

- Itemized Deductions

- 20% Qualified Business Income Deduction

- Opportunity Zone

- 1031 Exchanges

- Estate Taxes

This article does a good job of summarizing some of the changes:

https://www.elliottdavis.com/impact-of-bidens-tax-plan-on-real-estate-what-we-know/

6 Ways Biden's Tax Plan Could Affect Your Real Estate Business

When it comes to the real estate industry or investing in general, it's important to pay attention to policies that will affect you as a business owner so you can make the necessary adjustments. Some of the changes you will want to know about are in the areas of:

- Social Security Payroll Tax

- Tax Bracket For Ordinary Income

- Limiting Itemized Deductions

- Phasing Out the QBI Deduction

- Long- Term Capital Gains

- Lower Estate Tax Exemption

You can get a breakdown and explanation of how these items could affect you here:

COVID Impact on Foreclosures and Evictions

- Evictions and foreclosure moratorium is planned to be extended through at least March 31, 2021 (1 in 5 renters and 1 in 10 homeowners with a mortgage are behind on payments)

- Congress is being asked to provide rental assistance (more details will be coming soon on how the funds will be handled)VA and HUD are also requested to halt foreclosures until at least March 31, 2021

- Student loan principal and interest payments are requested to be paused until September 30, 2021 (most millennials affirm that student loans pose the greatest obstacle when considering purchasing a home

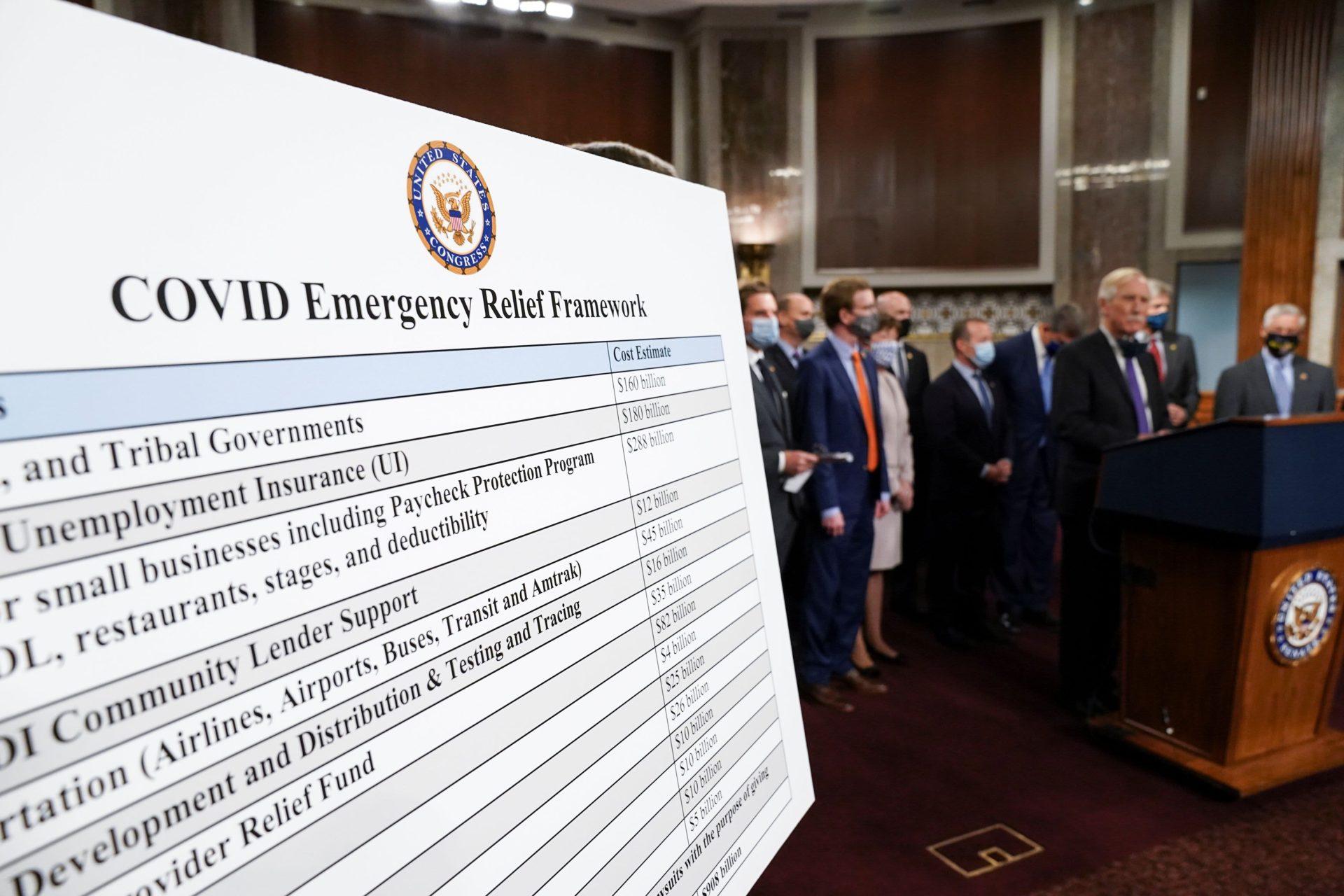

December COVID-relief Package

The December COVID-relief package included $25 billion for rental assistance.

The monies will be allocated to states through the Department of Treasury. State allocations will be based on population, no state will receive less than $200 million. The language allows landlords to apply for funds on behalf of tenants (with tenant consent).

Rental payments may include rent in arrears as well as utilities and “and other expenses related to housing.” More importantly, the rental payments will be made directly to the housing provider or utility provider, unless the payment is refused by same. These monies are now being distributed to the states, and should be available for application in the next few weeks.

The National Association of Realtors have done an excellent job of outlining the facts here:

https://www.nar.realtor/political-advocacy/coronavirus-housing-providers-faqs

Applicants must document that they have experienced a reduction in income, incurred significant costs, or experienced other financial hardship due to the COVID-19 outbreak

To the extent administratively feasible, grantees must require applicants to document that they have (1) qualified for unemployment benefits or (2) experienced a reduction in income, incurred significant costs, or experienced other financial hardship due directly or indirectly to COVID-19 that threaten the household’s ability to pay the costs of the rental property when due.

Grantees must also require applicants to demonstrate a risk of experiencing homelessness or housing instability, which may include past due rent and utility notices and eviction notices, if any, as part of the application process.

The US Department of Treasury has complied a very helpful Facts sheet here:

https://home.treasury.gov/system/files/136/ERA-Frequently-Asked-Questions_Pub-1-19-21.pdf

Mental health is as vital as physical health.

The resource library includes:

- Video Interview Series “Coping with Isolation” featuring hot rental housing industry topics like Impacts of Corporate Culture, Dealing with Personal Stress, When You’re at a Low Point and Attitudes of Mindfulness.

- How to Stay Connected during Physical Distancing highlights four ways to help prevent loneliness during intentional isolation.

- Your brain on social distancing and how to overcome loneliness and isolation.

- Insulating for Isolation: A mental health checklist for getting through quarantine.

- Tips for managing social isolation, staying healthy and connected

- Sharing Your Humanity focuses on how to overcome the hurdles created by the need for social distancing

- More info here: https://covidinitiative.rentalhousingindustry.org/mentalhealth

Pandemic Unemployment Assistance.

Pandemic Unemployment Assistance (PUA), is now available through March 14, 2021, which allows for up to 50 weeks of unemployment benefits to individuals not otherwise eligible, such as self-employed, who are unable to work as a result of COVID-19.

States will continue to run this program and regular state unemployment benefits under the CARES Act, until March 14, 2021. Eligible workers still receiving benefits as of March 14, 2021, would be able to keep receiving benefit until April 5 (if maximum number of weeks has not been reached). Recent federal legislation also extended the number of weeks PUA benefits were available from 39 to 50 weeks.

The Realtor Political Action Committee (RPAC) does an excellent job of summarizing the COVID Policies all in one place with loads of resources for your state and county here:

https://realtorparty.realtor/state-local-issues/resources/state-local-coronavirus-resources

Other Articles we found helpful on these proposed changes:

How President-Elect Joe Biden Proposes To Change Housing Policies

https://www.forbes.com/advisor/mortgages/biden-housing-policies/

Joe Biden’s Policies and How They Could Impact Your Money

https://www.daveramsey.com/blog/joe-biden-policies

HOW JOE BIDEN’S PRESIDENCY WILL AFFECT REAL ESTATEhttps://www.mashvisor.com/blog/joe-bidens-presidency-affect-real-estate/

Psssssttttt!!!

Mention this Newsletter and receive the first two months property management services for free with nothing due at sign up!

Check out our homepage for links to all of the property management services we provide. We service a 30 mile radius of the Gainesville FL area. Our website has information for all of our clients. Investors, Owners, Buyers, Sellers and Tenants.

We strive to offer the superior service, and to keep and earn future business, and your referrals.

Our featured article provides tips and insight to our current and future investors looking to fix and flip property or renovate and rent! Both options are lucrative and if you have interest in these types of purchases please get in contact with us. You can reach out to us via our contact page, the sidebar contact form on this article or by texting and or calling 352-478-8029.

We will be more than happy to provide you a free home evaluation. There is not any obligation to hire us for our services, and we are one of the top rental management companies Gainesville FL.